- General Dermatology

- Eczema

- Alopecia

- Aesthetics

- Vitiligo

- COVID-19

- Actinic Keratosis

- Precision Medicine and Biologics

- Rare Disease

- Wound Care

- Rosacea

- Psoriasis

- Psoriatic Arthritis

- Atopic Dermatitis

- Melasma

- NP and PA

- Skin Cancer

- Hidradenitis Suppurativa

- Drug Watch

- Pigmentary Disorders

- Acne

- Pediatric Dermatology

- Practice Management

Equity Indexed Life Insurance Policies and Structured Notes: Asset Classes With Principal Protection and Growth Potential

This article reviews equity-indexed life insurance policies and structured notes, instruments that offer investment protection and growth potential.

Even in good times many investors would be interested in assets that protect their principal when the market is down but still offer the opportunity for wealth creation. The volatility of the past few years—the rapid pullback in 2020, significantly bull market in 2021, and slow slide in 2022—has only increased this interest. This article reviews equity-indexed life insurance policies and structured notes, instruments that offer investment protection and growth potential.

Equity-Indexed Universal Life Policies

An equity-indexed universal life (EIUL) policy is a type of cash value life insurance. It has a cash value/investment component as well as a death benefit. Cash value policies are also called permanent policies because, unlike term policies, they don’t expire but instead are intended to be kept until the insured dies.

There are several types of cash value insurance, including variable and whole life, in which the cash values grow based on a variety of methods. With an EIUL policy, the cash values are used to implement a collar strategy.

In a collar strategy, the insurance carrier sells call options and buys protective put options on positions they own. In return, the policy’s performance is tied to an index, such as the S&P 500, the market capitalization-weighted index of the 500 largest publicly traded companies in the US.

Through the collar strategy, the carrier is able to guarantee the policyholder a floor, or minimum return (ie, 0%), that protects them from losses. With an EIUL, if the index the policy is tied to drops 20%, the cash value does not go down. EIUL policy cash values also have a ceiling or cap, which means that if the index rises beyond the cap, the policyholder will get only a portion of the upswing (ie, capped at 10%).

Because of their combined upside and downside protection, these products have been extremely popular since the Great Recession, with over $2 billion being invested in new EIUL policies in 2018 alone.1

EIUL Benefits

In addition, they offer the benefit of a tax-free increase in cash value that, if managed properly, can also be accessed tax-free. And in many states, the cash value is statutorily protected from lawsuits.

EIUL Risks

Like any investment product, EIUL insurance is subject to certain risks. One is that it is not 100% liquid; in fact, these policies generally have a surrender period of 8 to 12 years, during which, if the policy is completely surrendered, a charge is assessed against its cash value. But this charge may be avoided if only some, not all, of the cash value is withdrawn.

Another risk inherent in EIUL and other permanent life policies is the possibility that the insured will not be able to adhere to the premium schedule. A policy’s size and costs are based on the premium schedule created when the policy is implemented (ie, $10,000 per year for 10 years). Any deviation from this schedule can result in a significantly negative impact on policy performance.

Finally, because the policy’s cash value is managed by the insurance carrier, carrier solvency risk is also a factor, which is why using top-rated companies is crucial.

Structured Notes

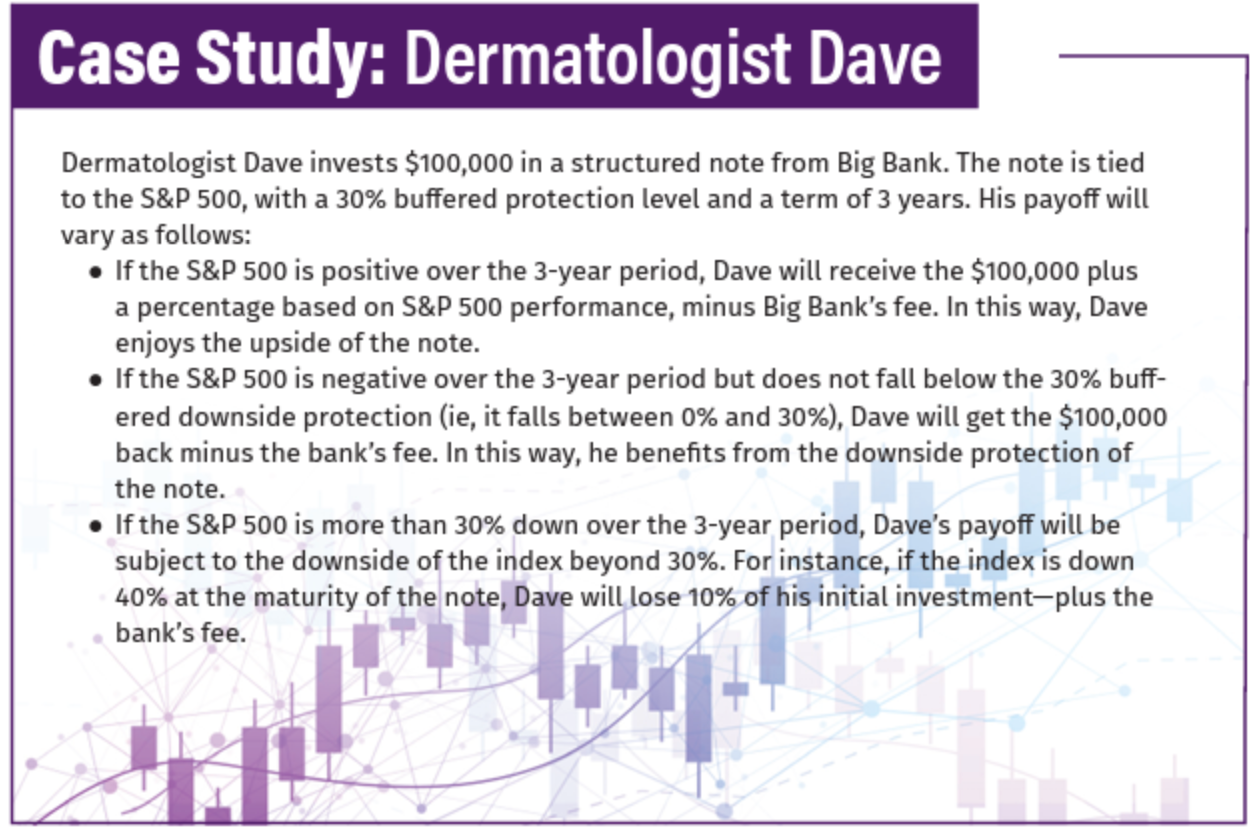

Structured notes are “hybrid” securities that combine the features of different financial products. Issued by some of the largest banks in the world, these notes combine bonds and other investments to offer the features of equity and debt assets. According to published studies, $2 trillion is currently invested in structured notes worldwide.

Structured notes are not direct investments. They are derivatives, as their value is derived from another, linked asset. The return on the note depends upon the issuer repaying the underlying bond and paying a premium based on the linked asset, minus the bank’s fee. They can mature as early as 6 months but typically range between 3 and 5 years.

Structured Note Risks

There are several risks inherent in a structured note investment, including:

- Complexity: Structured notes are complex financial instruments. Investors should understand the reference asset(s) or index(es) and determine how the note’s payoff structure incorporates them to calculate performance.

- Market Risk: Although some notes have buffers and other protection factors built in to reduce the impact of a bad market, the investor may still suffer a financial loss, as with any other investment that is not FDIC-insured or whose principal is protected.

- Lack of Liquidity: Should an investor need to access the funds in a structured note prior to maturity, he or she will be forced to sell the note on the open market. There may be a buyer willing to purchase it, but this will typically be at a deep discount, far less than what the note is worth.

- Issuer Risk: Ultimately, a structured note is only as strong as its issuer. If the issuer defaults, the entire principal could be lost.

Conclusion: Work with an Experienced Advisor

Both EIUL policies and structured notes can be valuable components of a dermatologist’s overall portfolio, especially for investors looking for principal protection without forgoing the potential for asset growth. Because these products are complex and contain inherent risks, working with a knowledgeable professional to evaluate options is always recommended.

David Mandell, JD, MBA, is an attorney and the author of more than a dozen books for doctors, including Wealth Planning for the Modern Physician. He is a partner in the wealth management firm OJM Group (www.ojmgroup.com).

Bob Peelman, CFP, is a partner and director of Wealth Advisors.

They can be reached at 877-656-4362 or mandell@ojmgroup.com.

Disclosure

OJM Group, LLC (“OJM”) is an SEC-registered investment adviser with its principal place of practice in the State of Ohio. SEC registration does not constitute an endorsement of OJM by the SEC nor does it indicate that OJM has attained a particular level of skill or ability. OJM and its representatives are in compliance with the current notice filing and registration requirements imposed upon registered investment advisers by those states in which OJM maintains clients. OJM may only transact practice in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. For information pertaining to the registration status of OJM, please contact OJM or refer to the Investment Adviser Public Disclosure website www.adviserinfo.sec.gov.

For additional information about OJM, including fees and services, send for our disclosure brochure as set forth on Form ADV using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

This article contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized legal or tax advice, or as a recommendation of any particular security or strategy. There is no guarantee that the views and opinions expressed in this article will be appropriate for your particular circumstances. Tax law changes frequently, accordingly, information presented herein is subject to change without notice. Seek professional tax and legal advice before implementing strategy discussed herein.

Wealth Planning for the Modern Physician and Wealth Management Made Simple are available free in print or e-book. Download by texting DERM to 844-418-1212.