- Acne

- Actinic Keratosis

- Aesthetics

- Alopecia

- Atopic Dermatitis

- Buy-and-Bill

- COVID-19

- Case-Based Roundtable

- Chronic Hand Eczema

- Chronic Spontaneous Urticaria

- Drug Watch

- Eczema

- General Dermatology

- Hidradenitis Suppurativa

- Melasma

- NP and PA

- Pediatric Dermatology

- Pigmentary Disorders

- Practice Management

- Precision Medicine and Biologics

- Prurigo Nodularis

- Psoriasis

- Psoriatic Arthritis

- Rare Disease

- Rosacea

- Skin Cancer

- Vitiligo

- Wound Care

Article

Avoid choosing the wrong investment firm for you

Over the past few years, many physicians have re-examined not only their investment assumptions, but also their relationships with investment advisory professionals. Declines in market values, such as the 2007-2008 40 percent drop in the S&P 500, often cause investors to rethink their investment strategies

Over the past few years, many physicians have re-examined not only their investment assumptions, but also their relationships with investment advisory professionals.

Declines in market values, such as the 2007-2008 40 percent drop in the S&P 500, often cause investors to rethink their investment strategies.

Today’s investors have an even greater concern with their investment advisory firms. The unraveling of Bernie Madoff’s and Allen Stanford’s Ponzi schemes made headlines nationwide. Many investors were shocked at the collapse of the supposedly-elite Bear Stearns and Lehman Brothers as a result of their own mismanagement. In April 2010, the SEC filed fraud charges against Goldman Sachs for actions that allegedly cost their investors more than $1 billion. More recently, JP Morgan took an estimated $3 billion loss on what its CEO Jamie Dimon called a “terrible, egregious mistake.”1

The volatility of market returns along with the cracking of the Wall Street foundation leaves many doctor-investors very uncomfortable with the idea of just staying the course. Who can blame physician investors for looking at other options for investment advice?

If you have thought about changing the direction you go with your investments or would value a second opinion on your current strategy, this article should prove helpful.

The dangers of reviewing a firm’s past performance

A very common mistake that retail investors, including physicians, make when evaluating or selecting their investment adviser is to overrate the importance of an adviser’s recent returns. There are reasons why this approach is flawed:

1. The time frame may be too short.

When looking at an investment track record, many clients will ask for gross returns (already a mistake - see below) on a one-, three- and five-year basis. This is simply not enough data to make any concrete conclusions about skill versus randomness or even luck. In fact, 10 years may not be enough.

An in-depth examination of this issue is well beyond the scope of this short article. However, if you are truly interested in learning more about why such measurements must be looked at over decades, and why most investment performance claims may be based in luck, we recommend you to read the best-selling book Fooled by Randomness by Nassim Taleb.

2. Comparisons of results likely not apples to apples.

Even the common question, “how did your portfolio perform (last year)?” can lead to misleading answers in cases where portfolios are designed for individual clients. For example, at our firm, many of our clients have customized portfolios - based on their risk tolerance, age, time horizon, tax bracket, objectives and a variety of other factors.

As a result of various factors, it is entirely possible that Client A could see returns of 3 percent and Client B could have a portfolio gain of 20 percent over the same period. Both of these investors could be equally satisfied (or dissatisfied) and neither of these results may give you any helpful advice about your particular situation (as Client C). Only in situations when two investors have very similar goals, circumstances and objectives is any comparison worthwhile.

3. Past performance is no guarantee of future results.

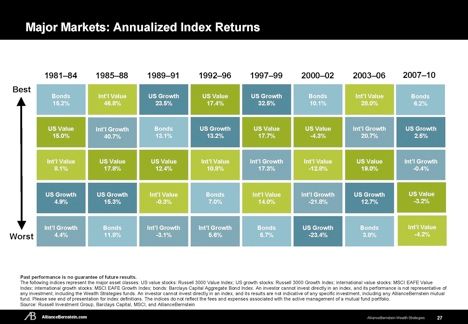

Anyone who has ever watched an investment firm’s commercial on television, listened to an advertisement on the radio or read one in a newspaper or magazine is familiar with the phrase “past performance is no guarantee of future results.” While this is required by the firm’s compliance department and can be easily discarded as legalese by consumers, it is crucial for investors to understand. To illustrate one aspect of this principle, please examine the chart below showing the returns of leading investment asset classes over the past 28 years.

Major markets: Annualized index returns

As you can see, there is no consistency from year to year. You cannot tell which asset class will have the highest returns, or the lowest, by simply looking at the recent historical data. This alone makes a strategy of chasing asset class-focused funds and managers based on their past results dubious at best.

Factors you should look for in your advisers 1. Two-way communication: A fundamental element of client service.

When polled, most clients of any professional adviser - from attorney, to CPA, to financial adviser - name “timely and effective two-way communication” as a crucial element of a fruitful working relationship. Still, many investment advisers seem to focus more on returns. Even for those advisers who value customer service, certain business models within the investment business make such communication almost impossible.

As an example, consider the entire mutual fund industry - which many physicians utilize for a substantial portion of their investment portfolios. What communication does one get from such a fund - prospectuses, monthly and annual statements, perhaps a newsletter?Is there any individual consultation with investors on the portfolio mix or the tax impact of the buying/selling within the fund or the impact sales could have on an investor’s tax liability? Generally, the answer is “no.” This is because the fund industry is built on a low-cost low-service model where two-way communication with the folks actually managing the fund is cost prohibitive and rarely permitted.

When choosing an investment adviser to manage your portfolio, even if this choice involves finding assistance in the management of mutual funds or ETFs within a portfolio, one should expect much more communication as a fundamental element of client service. This doesn’t simply mean that the adviser calls you when there is a hot new buy (as stockbrokers are notorious for). Rather, one should expect a defined communication process throughout the year that is independent of trade suggestions. Finally, we would recommend that the firm offers a reasonable policy of timeliness of returning phone calls and emails.

2. Transparent and client-aligned business model: A must in our view.

Given the troublesome conflicts of interest that have come to light in the investment industry over the past few years, we feel that all investors (not just physicians) should work with financial firms that use a transparent business model and one that aligns the firm’s interests with that of their clients. There are a number of elements to look for in such an arrangement:

A. Independent custodian: Ideally, an investment firm does not custodian (i.e., hold) its clients’ investments in the firm. Rather, the firm should have arrangements with a number of the largest independent custodians (such as Charles Schwab, TD Ameritrade, etc.) to hold their investments for safekeeping, while the investment firm manages the accounts. The inherent checks and balances of this type of arrangement prevent the insular secrecy that allowed Madoff, Stanford and other criminals to operate.

B. Client-aligned fee model: Many clients today, physicians among them, are realizing that a clear fee-based model works best for them. In such an assets under management (AUM) model, advisors charge a transparent, clearly-defined fee on assets they manage. Contrast this with the traditional convoluted transaction-charge model that most brokers utilize where a client pays based on trades in the account, regardless of whether the trade added value or not. In a fee-based model, not only do clients understand exactly what the fee is, but they also understand that the firm’s interest is the same as theirs - seeing the portfolio increase in value. The annual management fee the investment firm earns is a percentage of the assets you have in your account with them. The more money you have, the more money the firm earns.

Ask yourself: do you feel more comfortable paying advisers based on the performance of your portfolio or the number and size of the trades they make, regardless of performance?

3. Focus on your “net” return: What else matters?

Many investment clients focus primarily on management fees and expenses when evaluating advisers. While such costs are important, for most physicians, the annual fees might range from 50 basis points (0.5 percent) on the low end (very large portfolio in a fee model) to 300 basis points (or 3 percent) on the high end (mutual funds can be this high, as can broker transaction costs). Though this huge expense range (600 percent variability!) is one reason why we are so adamant about the AUM-based fee model above, this is NOT an investment client’s largest expense. Taxes are.

The cost of federal and state income and capital gains taxes on a portfolio depends on many factors – the underlying investments, the turnover, the structure in which the investments are held, the other income of the client, the client’s state of residence, and others. For higher income investors such as physicians, taxes will nearly always be high … and with the new tax changes coming, these costs are likely going to be even higher. To gain perspective of how much taxation reduces your returns, consider this:

Over the period from 1987-2007, stock mutual fund investors lost, on average, 16-44 percent of their gains to taxes.2

Given that some investors are losing between one-sixth and nearly half of their gains to taxes, one would think this would be a focus of value-added investment firms. Unfortunately, mutual funds themselves provide no tax advice to their investors. They provide only 1099 tax statements in January.

Even stockbrokers, money managers, hedge fund managers and financial advisers at the nation’s largest or most prestigious niche firms do not offer tax suggestions - and their compliance departments are glad they don’t - because they are prohibited from doing so. Tax advice could include specific techniques for limiting tax consequences of transactions or more general tax diversification in portfolios. As a result of these limitations, most investment clients are not getting the tax suggestions they want.

But don’t investors want this tax focus from their investment firms? What is more important to you: the gross return your investment firm boasts in its marketing materials or your net after-tax return? Unless you generously want to give more to state and federal governments than you need to, the net after-tax return is the only measure that should truly matter.

With full disclosure, our firm is one that understands the focus on after-tax returns. That is one of the reasons we have two advisers with CPA designations on our team. While we are certainly not the only firm that does so, very few firms offer this expertise. As capital gains and income taxes - both at the state and federal level - may rise in the near future, we would expect more investors to look for tax expertise in their investment team as well.

Conclusion

With the unraveling of some of the country’s leading investment firms behind us, and volatility and tax increases ahead of us, many physician investors are wisely re-examining their financial adviser relationships. If you are one of these physicians, be sure to focus on the right factors in evaluating potential new advisers so you make intelligent, well-informed decisions. The authors welcome your questions. You can contact them at 877-656-4362 or through their website www.ojmgroup.com.

Jason O’Dell, MS, CWM is a principal at the consulting firm of OJM Group, LLC. Andrew Taylor, CFP is a member of OJM Group’s Investment Team. They advise hundreds of physicians across the country on investments, and are always interested in speaking with doctors throughout the U.S. They can be reached at 877-656-4362.

1. Jamie Dimon, CEO JP Morgan Chase, to NBCÕs David Gregory, Meet the Press, May 13, 2012

2. Mutual fund tracker Lipper, quoted on CNN/Money.com 4/17/07

Newsletter

Like what you’re reading? Subscribe to Dermatology Times for weekly updates on therapies, innovations, and real-world practice tips.