- Acne

- Actinic Keratosis

- Aesthetics

- Alopecia

- Atopic Dermatitis

- Buy-and-Bill

- COVID-19

- Case-Based Roundtable

- Chronic Hand Eczema

- Chronic Spontaneous Urticaria

- Drug Watch

- Eczema

- General Dermatology

- Hidradenitis Suppurativa

- Melasma

- NP and PA

- Pediatric Dermatology

- Pigmentary Disorders

- Practice Management

- Precision Medicine and Biologics

- Prurigo Nodularis

- Psoriasis

- Psoriatic Arthritis

- Rare Disease

- Rosacea

- Skin Cancer

- Vitiligo

- Wound Care

Article

In-demand dermatology treatment devices

Author(s):

A rising prevalence of skin disorders, including melanoma, will drive the need for diagnostic imaging and treatment technologies in dermatology, market analysts say.

A rising prevalence of skin disorders, including melanoma, will help drive the need for diagnostic imaging and treatment technologies in coming years. In fact, high worldwide skin cancer rates and related technological advances propelled imaging devices to lead the market in 2016. Devices to diagnose skin cancer - melanoma, in particular - were the biggest revenue generators in 2016, says Shailendra Gaikwad, a senior research analyst for Grand View Research in San Francisco.

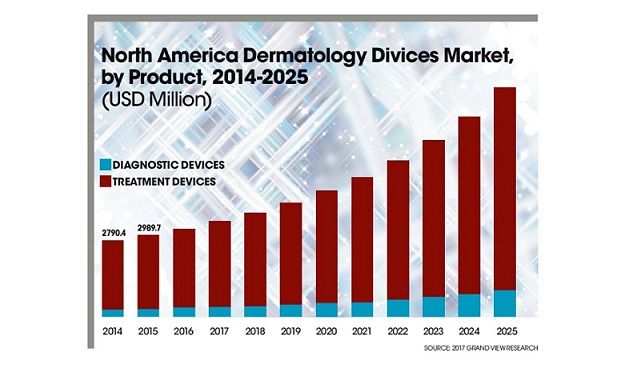

North America will likely continue to lead the global market for dermatological and skin rejuvenation devices in 2018, according to the most recent Grand View Dermatology Devices Market report. The report is based on 150 interviews with device manufacturers, distributors and end-users, including dermatologists.

But it isn’t only skin cancer that will fuel demand for medical dermatology diagnostic and treatment devices. Other areas forecasted to “gain lucrative growth” are acne, psoriasis and tattoo removal, according to the report.

Laser instruments and light therapy to treat acne and other conditions are expected to experience high growth in the coming decade. These device types have been shown to be technologically advanced for improving aesthetic treatment outcomes, which appeals to the market, Gaikwad said.

Light therapy devices designed to treat skin lesions, held the largest worldwide market share in 2016. North America led the global market that year, boosted by the region’s high use of light therapy and laser-based instruments for medical and cosmetic purposes, according to the report.

North America dominated the market in light therapy and laser devices, in part, because the cost for these procedures doesn’t impact people in North America to the degree that it may impact people in other areas of the world, he said.

Medical dermatology imaging devices are expected to continue to dominate the North American derm diagnostic device market, according to Gaikwad.

“Treatment devices [including laser and light therapy devices] are more costly compared to diagnostics,” he says. “Diagnostic devices are expected to grow at a higher rate as compared to treatment devices. We have a specific driver of an increasing number of skin cancers. Diagnoses of skin cancers is very important in the preliminary stage and that’s where imaging devices play a major role.”

Among dermatology treatment devices, light therapy devices, such as intense pulsed light (IPL), will experience the biggest growth worldwide from now to 2025.

Gaikwad says Valeant Pharmaceuticals, Cynosure, Alma Lasers, Cutera, Lumenis and Syneron Medical will show a significant growth in future, due to robust portfolios and strong geographic presences.

A strong device market in the coming years could be good news for dermatologists who have invested or will invest in medical and aesthetic dermatology products and technologies, he says.

NEXT: GROWTH IN THE AESTHETICS INDSUTRY

“Diagnostic devices are expected to grow at a higher rate as compared to treatment devices. We have a specific driver of an increasing number of skin cancers. Diagnoses of skin cancers is very important in the preliminary stage and that’s where imaging devices play a major role.”

- Shailendra Gaikwad, senior research analyst, Grand View Research, San Francisco

AESTHETICS GROWTH

Global aesthetic procedure statistics by the International Society of Aesthetic Plastic Surgery (ISAPS) indicate a growing demand for aesthetic procedures. In the latest ISAPS 2016 statistics, there was an overall increase of 9 percent in surgical and non-surgical cosmetic procedures from the beginning to the end of the year, with the U.S., Brazil, Japan, Italy and Mexico accounting for 41.4 percent of the world’s cosmetic procedures.

Medical devices in the categories of hair removal, skin rejuvenation, tattoo removal, body contouring and fat reduction are among those forecast in the next decade to lead the way.

“Aesthetics is an emerging field, and with the increasing awareness amongst people, aesthetic procedures for treating hair- and skin-related disorders are on the rise. This will help increase the market for dermatologic devices significantly,” Gaikwad said.

Obesity, a factor driving patients to doctors in other specialties, also is behind a push for higher demand in the aesthetic realm, for fat removal and liposuction devices, he said.

Aesthetics will continue to be a major market driver for dermatologic devices, which is expected to trickle down into business for the practicing dermatologist, according to Gaikwad.

GLOBAL MARKET

The global dermatology devices market, including treatment devices in medical dermatology and aesthetic procedures, was $8.74 billion in 2016. It is expected to be $25.7 billion in 2025, largely due a growing awareness about aesthetic procedures and increasing incidences of skin disorders such as psoriasis, acne, eczema and skin lesions, according to the Grand View report.

While the U.S. and Canada are expected to lead regional growth in the dermatologic device market through 2025, other big players include Europe (Germany and the UK), as well as the Asian Pacific region, which encompasses Japan, China and India. Lucrative growth in Asia Pacific countries will likely get a boost from medical tourism and the promise of low-cost treatments, according to the report.

REFERENCES

Dermatology Devices Market Size, World Industry Report, 2014-2025. Grand View Research. Feb. 2017.

Newsletter

Like what you’re reading? Subscribe to Dermatology Times for weekly updates on therapies, innovations, and real-world practice tips.