- Acne

- Actinic Keratosis

- Aesthetics

- Alopecia

- Atopic Dermatitis

- Buy-and-Bill

- COVID-19

- Case-Based Roundtable

- Chronic Hand Eczema

- Chronic Spontaneous Urticaria

- Drug Watch

- Eczema

- General Dermatology

- Hidradenitis Suppurativa

- Melasma

- NP and PA

- Pediatric Dermatology

- Pigmentary Disorders

- Practice Management

- Precision Medicine and Biologics

- Prurigo Nodularis

- Psoriasis

- Psoriatic Arthritis

- Rare Disease

- Rosacea

- Skin Cancer

- Vitiligo

- Wound Care

Article

Evaluate stock's downside risk by using five measures

While all financial ratios are important in determining if a stock may be over- or under-valued, combining the ratios can prove very beneficial.

Q.Is there any way to determine the best time to sell a stock if it hasn't performed as well as expected?

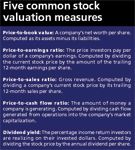

There are several possible approaches to calculating a stock's downside potential. The five most common valuation measures for stocks are: price-to-book value, price-to-earnings ratio, price-to-sales ratio, price-to-cash flow ratio, and dividend yield. A general understanding of these measurements should shed some light on share pricing factors.

Newsletter

Like what you’re reading? Subscribe to Dermatology Times for weekly updates on therapies, innovations, and real-world practice tips.

Related Videos

How OX40-Targeted Therapies Might Reshape Biologic Strategy in AD

Expanding Topical Non-Steroidal Options in Atopic Dermatitis to Reduce Chronic Steroid Use

Understanding the Role of OX40 in Next-Generation Eczema Therapies

Jonathan Silverberg, MD, PhD, MPH on Keeping Up With Rapid AD Developments

The Vicious Cycle of Itch, Stress, and Sleep Loss

Christopher Bunick, MD, PhD, Previews RAD 2025: Raising the Bar in Atopic Dermatitis Care

Current Unmet Needs and Emerging Solutions in Atopic Dermatitis Management

Implementation Factors Affecting Ruxolitinib Adoption in Pediatric Dermatology Practice

Regulatory Challenges and Clinical Differentiators for Pediatric Atopic Dermatitis Treatments

Evaluating the Impact of Topical JAK Inhibitors on Pediatric Atopic Dermatitis Guidelines