- Case-Based Roundtable

- General Dermatology

- Eczema

- Chronic Hand Eczema

- Alopecia

- Aesthetics

- Vitiligo

- COVID-19

- Actinic Keratosis

- Precision Medicine and Biologics

- Rare Disease

- Wound Care

- Rosacea

- Psoriasis

- Psoriatic Arthritis

- Atopic Dermatitis

- Melasma

- NP and PA

- Skin Cancer

- Hidradenitis Suppurativa

- Drug Watch

- Pigmentary Disorders

- Acne

- Pediatric Dermatology

- Practice Management

- Prurigo Nodularis

- Buy-and-Bill

Article

Pre-emptive protection: Devise a strategy to guard your wealth against future tax increases now

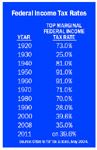

In 2008, many Americans were left with a general sense of concern for our economy. The mortgage and credit crisis, presidential election and record federal budget deficits have caused many of our physician clients to believe that taxes will increase.

Key Points

Though it is possible (albeit slightly) that taxes will not be increased in the next four years, it is irresponsible to assume that taxes will never increase again. Since we can't possibly know when we will retire, what tax rates will be when we retire, or how long we will live after we retire, we have to make every effort to add tax flexibility into long-term retirement planning.

We spread our investments across different classes to ensure that if something negative impacts one company or one industry, the total portfolio is not significantly affected.

With tax diversification, a similar theory applies. If you have some investments that may be taxed as ordinary income, some that may be taxed at capital gains or dividend tax rates, and have some assets that may not be taxable at all, you have flexibility. When ordinary income tax rates are very high, you may choose to spend assets that are taxed at low capital gains tax rates, or not taxed at all. When rates are low, you may choose to pay those taxes now.

For example, most wise real estate investors in the past few years have not made 1031 exchanges. They volunteered to pay the 15 percent capital gains taxes. Others deferred the tax and may have to pay rates of 20 percent or 28 percent when they sell (if rates increase).

The goal is to have flexibility so you are never at the mercy of one legislative change.

The concept is quite simple. A properly tax-diversified portfolio minimizes the risk of loss when taxes increase, and provides flexibility that can afford savvy taxpayers the opportunity to minimize total taxes paid over a lifetime of investing.