- Acne

- Actinic Keratosis

- Aesthetics

- Alopecia

- Atopic Dermatitis

- Buy-and-Bill

- COVID-19

- Case-Based Roundtable

- Chronic Hand Eczema

- Drug Watch

- Eczema

- General Dermatology

- Hidradenitis Suppurativa

- Melasma

- NP and PA

- Pediatric Dermatology

- Pigmentary Disorders

- Practice Management

- Precision Medicine and Biologics

- Prurigo Nodularis

- Psoriasis

- Psoriatic Arthritis

- Rare Disease

- Rosacea

- Skin Cancer

- Vitiligo

- Wound Care

Publication

Article

Dermatology Times

Can I charge uninsured patients more?

Author(s):

It is common knowledge that both not-for-profit and for-profit hospitals across the U.S. have policies of charging uninsured patients more. And some physicians have done the same. But patients are starting to question these policies, landing some hospitals and physicians in hot water.

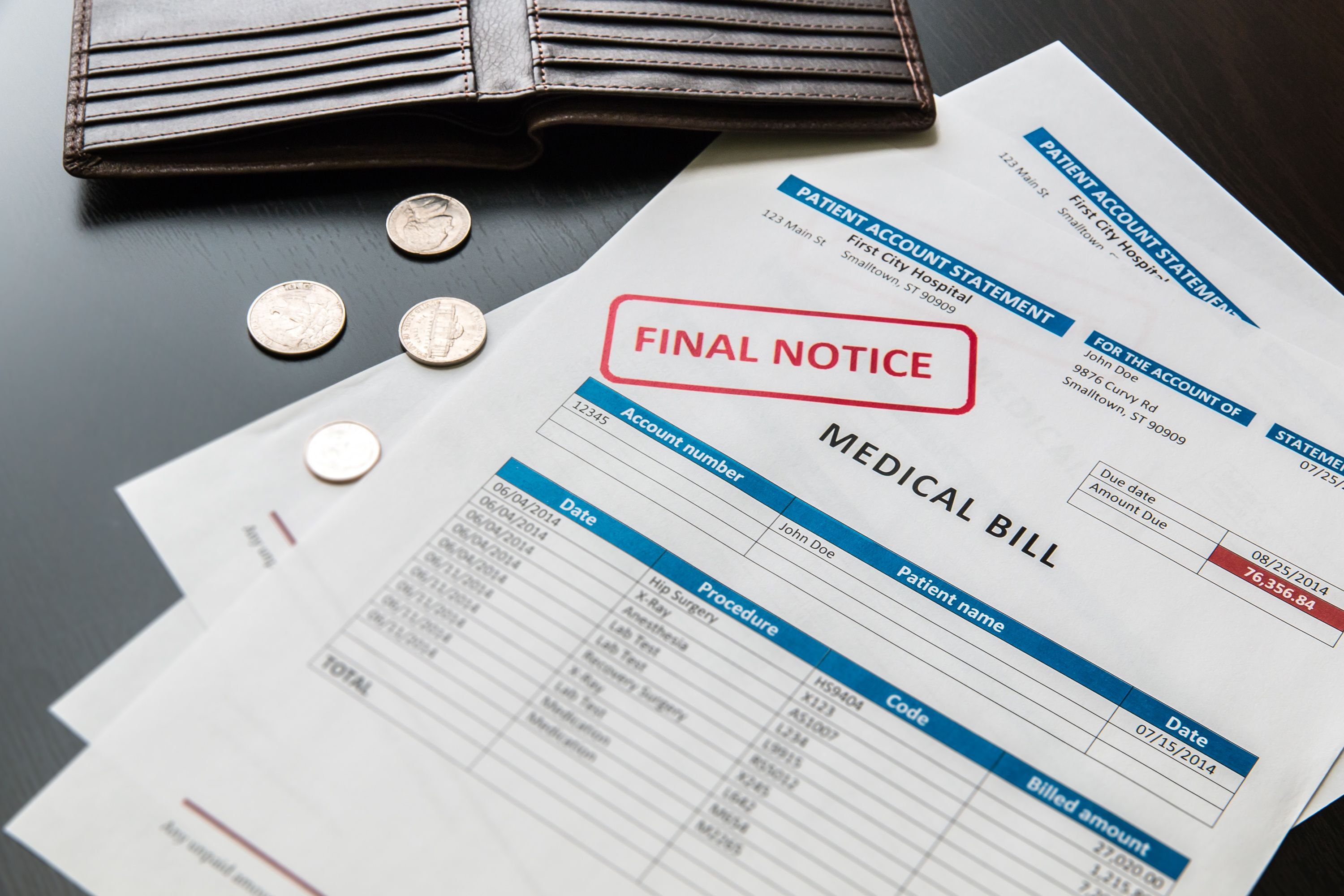

Uninsured patients make up an ever increasing number of lower and middle income classes of Americans, and are paying higher prices for the same medical care. Some have even been aggressively pursued by collection agencies if they fail to pay their medical bill. (volgariver - stock.adobe.com)

Dr. Fees has a large dermatology practice in an Appalachian community that, despite the ACA, has seen an increased number of people without health insurance. In fact, these patients have presented him with a unique economic advantage. He charges his uninsured patients double what he bills to contracted managed care insured patients.

Not only does he charge these patients more, but he also aggressively pursues them with collection agencies if they fail to pay. He thinks of himself as a quality physician and a smart business man. Much to his surprise, he is sued by one uninsured patient over his dual pricing.

Can Dr. Fees charge uninsured patients more?

In recent years, the United States has seen countless similar stories with regard to physician and hospital charges. Although patients with private or governmental insurances receive huge discounts for medical care, uninsured patients, who make up an ever increasing number of lower and middle income classes of Americans, pay higher prices for the same medical care. Apparently this pricing disparity has gone on for years, but over the last decade has been highlighted through stories in the Wall Street Journal and on CBS’s 60 Minutes. In one report, it was estimated that uninsured patients were charged two-and-a-half times more than a patient covered by one or more of the major insurance companies. The disparity is further accentuated by the fact that these inflated charges are not a voluntarily assumed debt, but rather, one that often cannot be avoided by the patient.

It is common knowledge that both not-for-profit and for-profit hospitals across the United States have policies of charging uninsured patients more. Some physicians have done the same. However, over the last decade, uninsured patients have increasingly sued hospitals for such policies. The claims have been based on several theories, one being that such differential billing policies violate state consumer protection statutes. Such lawsuits are based on the theory that uninsured patients have been subject to discrimination. The success of these claims depends on the state statutes where the litigation has been filed.

In Morrell v. Wellstar Health System, a patient argued the hospital violated the Georgia Uniform Deceptive Trade Practices Act because it charged unreasonable rates and charged the uninsured higher rates than insured patients. The Georgia statute at issue prohibited fraudulent misrepresentation, false advertising, or false and misleading statements. The court found nothing illegal about the hospital’s policies, because the hospital made patients aware of its fees. Despite this, and similar decisions, some uninsured patients have been successful in their consumer protection claims.

In Servedio v. Our Lady of the Resurrection Medical Center, a lawsuit was brought by several uninsured patients who owed the hospital more than $60,000. The patients were unable to pay for their medical services and the hospital vigorously tried to collect the debt. The patients claimed they were charged inflated rates compared with insured patients, they were not considered for charity care, and excessive collection methods were used. In fact, Resurrection Medical Center had the highest charge-to-cost ratio of any Chicago hospital. The Illinois court ruled that medical services sold by a hospital were a form of trade or commerce, and that the hospital’s conduct was immoral, unethical, oppressive, and clearly against public policy.

Litigation entitled In re. Sutter Health Uninsured Pricing Cases, a group of uninsured patients of a California hospital alleged they were charged unreasonable rates compared to those charged to insured patients. The California Supreme Court noted that under the California Unfair Competition Law, any “unlawful, unfair, or fraudulent business act or practice” was a violation. Ultimately, Sutter agreed to a policy that provided discounts to uninsured patients.

Dr. Fees’ state statutes on unfair practices will determine whether he loses his lawsuit. He will likely need advice from a health law attorney. With today’s social media reach, one may question the long-term wisdom of such a practice.

Newsletter

Like what you’re reading? Subscribe to Dermatology Times for weekly updates on therapies, innovations, and real-world practice tips.