- Acne

- Actinic Keratosis

- Aesthetics

- Alopecia

- Atopic Dermatitis

- Buy-and-Bill

- COVID-19

- Case-Based Roundtable

- Chronic Hand Eczema

- Drug Watch

- Eczema

- General Dermatology

- Hidradenitis Suppurativa

- Melasma

- NP and PA

- Pediatric Dermatology

- Pigmentary Disorders

- Practice Management

- Precision Medicine and Biologics

- Prurigo Nodularis

- Psoriasis

- Psoriatic Arthritis

- Rare Disease

- Rosacea

- Skin Cancer

- Vitiligo

- Wound Care

Publication

Article

Dermatology Times

Rule 1 for Investing During Volatile Markets: Stick to Your Plan

In this month's financial planning column, the OJM group talks about volatile markets and how to navigate investing in uncertain times.

As the end of 2022’s first quarter nears, plenty of news headlines might raise concern about the financial markets, from the devastating impact of the latest COVID-19 variant to worries about the ripple effects of the December 2021 decision to raise the US government’s debt ceiling. Will the Federal Reserve raise interest rates 5 to 7 times this year, as some analysts predict? Will the United States reach full employment? The forecast for the next 12 months invites a long list of questions.

One thing we know for certain is that the future will never be all sunny; there will be periods of market volatility in the short, medium, and long term. That is simply part of investing.

“WHAT SHOULD I DO?”

All this leads to a common but crucial question for many dermatologists: “What should I do?” In terms of personal finances and investing, the answer is simple but often not easy: Stick to your plan.

Sticking to the plan does not mean doing nothing. Dermatologists can take many actions—ideally, in conjunction with a trusted financial professional—to protect and build family finances during this or any crisis. These moves include revisiting retirement/financial models (focusing on cash reserves and potential spending cuts) and repositioning the portfolio with a possible rebalance of asset classes to their strategic benchmarks. Some dermatologists may need to raise cash, whereas others may allocate more to equities, seeing lower stock prices as a buying opportunity for the long term. These tactics may all make sense and should be guided by rational planning.

In other words, “stick to your plan” really means sticking with a long-term financial and investment plan and avoiding emotional decision-making. Actions driven by fear—or the urge to just “do something”—often feel right when watching hard-earned savings quickly evaporate but can lead to disastrous long-term financial consequences.

TIMING THE MARKET

Trying to time the market is the opposite of sticking to the plan. In essence, market timing means selling assets when one thinks the market will continue to decline and buying back in when it feels safe to conclude that the market has bottomed out. That may sound enticing in theory; in practice, however, the evidence is overwhelming that most investors diminish their long-term returns trying to use this strategy. They are more likely to chase the market up and down and get whipsawed, buying high and selling low. Market timing, though tempting, involves getting nearly impossible decisions right: when to sell and when to get back in.

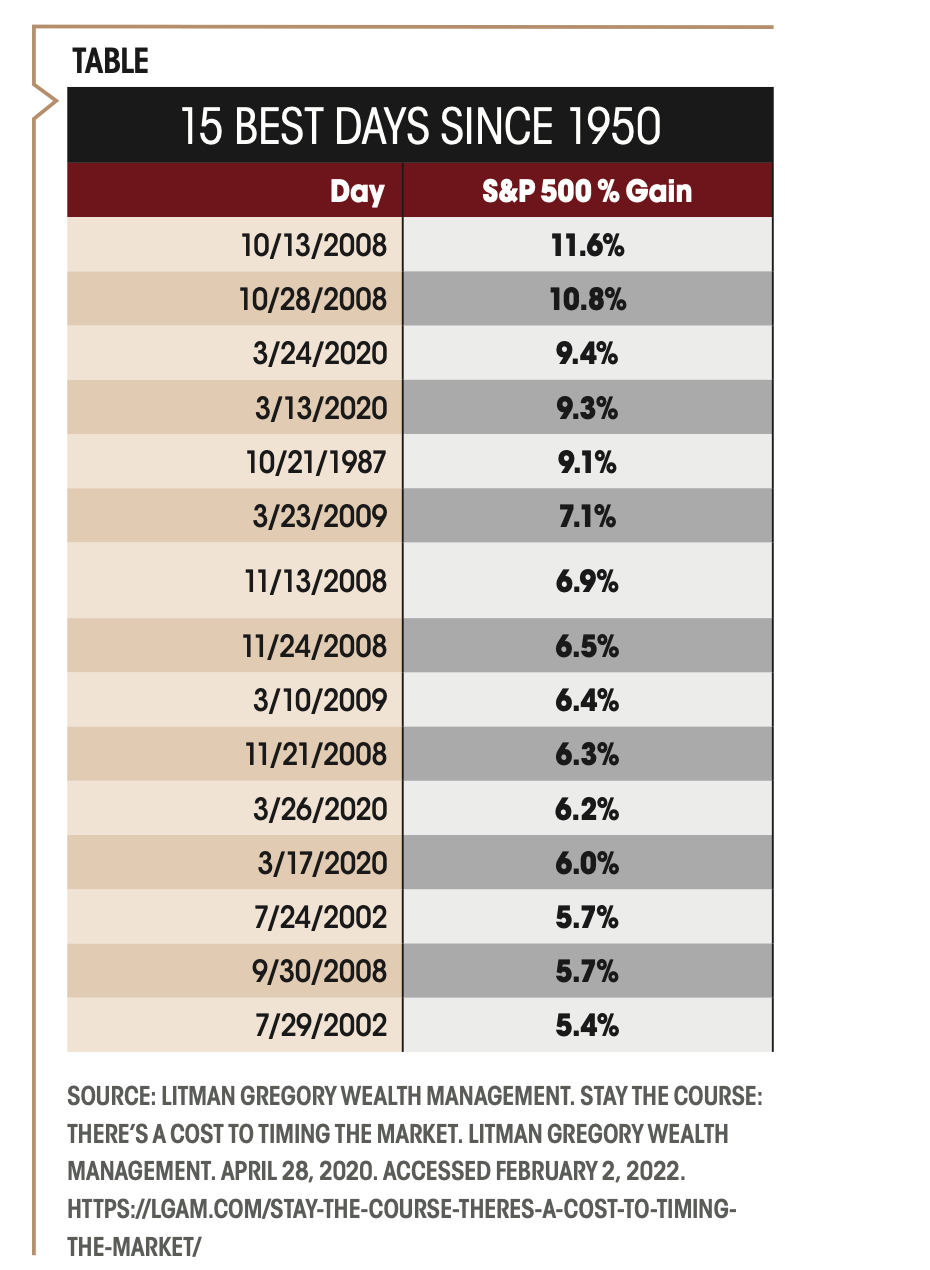

DATA FROM THE PAST 70 YEARS

The Table shows that the 15 best days for the S&P 500 (through March 31, 2020) all occurred within bear markets—not bull markets, as one might expect. In other words, the best days to be in the market occurred when it was hardest to remain invested or tempting to get out and wait for better days. These dates reflect a “who’s who” of dark times for the stock market: the 2008 financial crisis, the dot-com crash, and the Black Monday crash of 1987. A handful even happened in the first quarter of 2020, during the onset of the COVID-19 crisis.

By trying to miss the worst days, investors are likely to miss the best days. Let’s examine how detrimental this can be.

Table 1

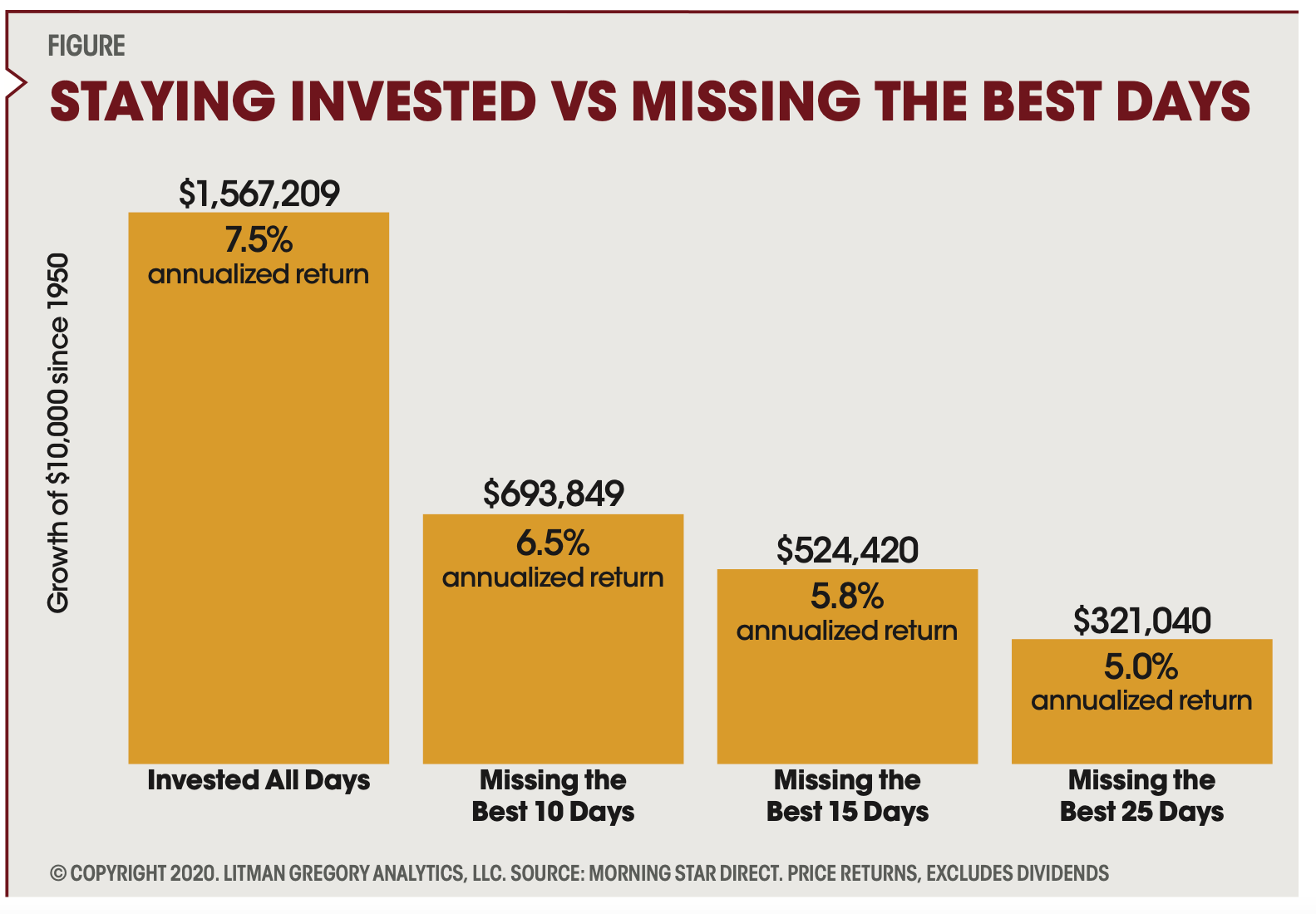

THE EXTRAORDINARY DAMAGE OF MISSING A FEW DAYS

The Figure shows that missing just the 10 best days (out of more than 17,500 trading days since 1950) has a significant long-term effect on a portfolio. For example, an investor who invested $10,000 in the S&P 500 in 1950 would have gained 7.5% annualized. That investor would have finished with a portfolio value of more than $1.5 million (as of March 31, 2020) if they had remained fully invested (not including dividends).

Figure 1

However, the portfolio value for an investor who missed the 10 best days is much lower—just shy of $700,000. It is unlikely that an investor will miss only the best days by attempting to time the market. They might also be able to miss some of the historically bad days. However, the cautionary tale of trying to time the market is the same: There can be an enormous cost if the market swings to the upside while the investor is on the sidelines. It would take a crystal ball to get in and out of the market perfectly, particularly since it needs to be done in short order, given that best and worst days tend to cluster close to one another. Investors also should be aware of the tax implications associated with attempts to time the market, which often can make the tactic even more painful.

CONCLUSION

Although owning stocks on historically bad days can be unsettling, staying the course is the best plan of action during periods of severe market stress. Dermatologists, like all investors, would do well to remember the investing adage “Time in the market beats timing the market” and avoid emotional decisions regarding their finances. Working with a trusted, experienced financial professional can help keep an investor on the right path.

Disclosure

OJM Group, LLC (OJM), is a US Securities and Exchange Commission (SEC)– registered investment adviser with its principal place of practice in the state of Ohio. SEC registration does not constitute an endorsement of OJM by the SEC nor does it indicate that OJM has attained a particular level of skill or ability. OJM and its representatives are in compliance with the current notice filing and registration requirements imposed upon registered investment advisers by those states in which OJM maintains clients. OJM may only transact practice in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. For information pertaining to the registration status of OJM, please contact OJM or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec. gov). For additional information about OJM, including fees and services, send for a disclosure brochure as set forth on Form ADV using the contact information on the website. Please read the disclosure statement carefully before you invest or send money.

This article contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized legal or tax advice or as a recommendation of any particular security or strategy. There is no guarantee that the views and opinions expressed in this article will be appropriate for your particular circumstances. Tax law changes frequently; accordingly, the information presented here is subject to change without notice. You should seek professional tax and legal advice before implementing any strategy discussed here.

Newsletter

Like what you’re reading? Subscribe to Dermatology Times for weekly updates on therapies, innovations, and real-world practice tips.