- Acne

- Actinic Keratosis

- Aesthetics

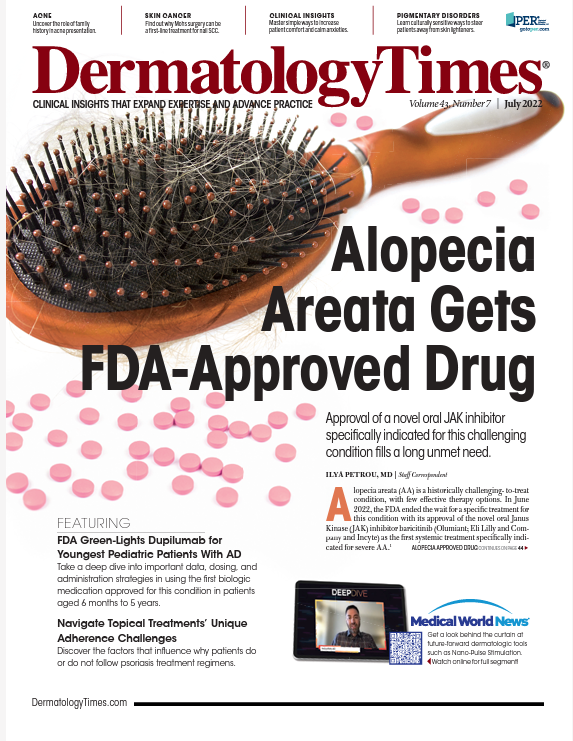

- Alopecia

- Atopic Dermatitis

- Buy-and-Bill

- COVID-19

- Case-Based Roundtable

- Chronic Hand Eczema

- Chronic Spontaneous Urticaria

- Drug Watch

- Eczema

- General Dermatology

- Hidradenitis Suppurativa

- Melasma

- NP and PA

- Pediatric Dermatology

- Pigmentary Disorders

- Practice Management

- Precision Medicine and Biologics

- Prurigo Nodularis

- Psoriasis

- Psoriatic Arthritis

- Rare Disease

- Rosacea

- Skin Cancer

- Vitiligo

- Wound Care

Publication

Article

Dermatology Times

What Practice Owners Need to Know When Considering a Sale or Merger

David B. Mandell, JD, MBA, and Jason M. O'Dell, MS, CWM examine 4 important success factors dermatologists should implement in their practice when considering a sale or merger.

The prevalence of mergers and acquisitions (M&A) has become a major trend in the dermatology specialty in recent years. Frequently, these deals have taken the form of smaller dermatology practices being merged into larger groups or “platform practices”—those that bring on an investment partner and acquire a host of smaller practices in a geographic region. Many dermatologists are debating whether they should participate in this trend while others are being actively recruited by financial firms.

In this article, we will examine 4 success factors that a dermatologist should implement when considering a sale or merger.

1. PREPARE YOUR PRACTICE FINANCIALLY.

Preparing the practice financially not only means having the books and records organized and in order, but also can be more broadly defined as “maximizing the value of the practice” to a potential buyer. This objective can be achieved by creating processes and procedures for everything in the practice that is not clinical—from patient intake and checkout to follow-up post appointment and marketing.

One well-known practice consultant uses the example of a 35-point bathroom-cleaning checklist that a successful practice has put in place. Another expert, a pilot for a major airline, recently spoke at a cosmetic surgery meeting about lessons a medical practice could learn from airline industry processes to improve patient safety. These examples share a common message: Apply a hyper focus on process design and implementation to every internal procedure and patient interaction, and the “systematizing” of a practice becomes inevitable.

Not only do such systems add value to a buyer (because they know the practice is regimented and can thrive through systems rather than 1 person running the show), but they also add significant value to the practice even if you ultimately decide not to sell. By implementing streamlined procedures throughout the practice, it will run more efficiently on a day-to-day basis, be able to survive employee turnover, and likely will be more profitable even if a sale never occurs.

Preparing the practice financially also includes maximizing earnings before interest expense, income taxes, depreciation, and amortization expense (EBITDA). Nonrecurring expenses, owner-related expenses, and excess owner compensation are often added back in the equation. This calculation allows the potential buyer to determine what the practice’s profit would be if the buyer owned the practice and had to pay reasonable compensation to physician employees to run it. Once again, getting a good handle on your practice’s EBITDA today and looking for ways to improve it may prove very valuable, whether you sell the practice or not.

2. DETERMINE THE RIGHT TYPE OF TRANSACTION.

When it comes to M&A, 1 size does not fit all. One practice owner might be looking to sell 100% and consider the transaction as a type of exit from their current practice. Another may be exploring the sale of a majority ownership or minority stake, and others may consider a combination of equity (ownership) and debt. The choice depends on whether the owners plan to relinquish control of the practice, want to add a financial partner to help them grow but stay in control, or hope to achieve some other objective.

Larger practices, especially those with highly effective systems and EBITDA, may consider becoming a platform practice. For smaller practices, the most realistic option is to be acquired/merged into a larger practice. Many of these deals are extremely lucrative, so this scenario should not be seen as a negative.

3. FIND THE RIGHT ADVISORY TEAM.

This may be the most important factor because the right advisory team will provide the expertise to make sure the other factors are in place. They will help to properly prepare the practice, maximize EBITDA, and secure the right type of transaction.

Who is on the advisory team? The team should start with the personal financial advisor(s) for the partners who can advise the physicians on the ramifications of a transaction on their personal finances and life goals. If a potential deal doesn’t fit with the physician’s personal life and financial goals, why even consider it? Physicians must understand what a potential sale/merger will mean for their long-term financial goals—with financial modeling being an essential task. Quantifying how a dermatologist’s financial position will change with a potential windfall (considering all taxes, of course) and lower ongoing income is key to our conversations when advising clients.

Beyond the physician’s personal financial advisors, the team should involve other advisors to the practice, including a certified public accountant (CPA), often from the dermatologist practice’s CPA firm. A special transaction CPA with experience in these types of deals may also be involved.

An M&A attorney, ideally with experience in medical practice transactions, is also an essential member of the team. The attorney ultimately will be the individual responsible for representing the practice to make sure that the agreements reflect the best possible deal for the practice and its owners.

Although the team ideally should include an investment banker who represents the practice, many physicians make the mistake of excluding this advisory role. A well-qualified investment banker, especially one with experience in medical practice sales, can add many multiples of their fee in value to the deal.

Based on our work, an investment banker should make clear that their knowledge of the industry (what deals have transpired at what values) and competitive process (bringing in other potential buyers to create bidding activity) typically puts the practice in a much better position than if the banker had never been involved. In fact, many bankers work primarily on a “success fee,” which ensures that they do well only if the practice does well. This alignment is crucial to ensure both the banker and client practice are focused on the same goal.

4. PREPARE MENTALLY FOR THE “WHY” BEHIND THE DEAL.

When a transaction occurs, things may change dramatically, including practice operations, physician compensation, and employee management. To ensure everyone feels positive on the other side of the transaction, each participant should understand their personal goals and motivations for the deal from the outset.

For example, if you will remain in the practice post sale, which is quite common, you should understand your motivation going into the transaction and think through what your practice and life will look like years after. This will force you to consider the following questions:

- Why are you doing the deal? Is it because you want to give up administrative headaches and let somebody run the business part of the practice? If so, will you be comfortable taking direction from others and not being in control?

- If the motivation is more financial, will you be OK with lower ongoing income after the deal is complete? Do the financial expectations meet what you have modeled for your personal financial goals?

CONCLUSION

As M&A deals continue in the specialty, many dermatologists eventually will consider becoming part of the trend. This article outlines a few success factors to implement if a merger or sale becomes a real possibility for you and your practice. Be sure to consider these factors well in advance of completing a deal or even signing a letter of intent. Building the right advisory team around you is a wise first step.

Disclosure:

Mandell is an attorney and founder of the wealth management firm OJM Group in Cincinnati, Ohio. O’Dell is a managing partner and financial adviser at OJM Group.

OJM Group, LLC (“OJM”) is a Securities and Exchange Commission (SEC)–registered investment adviser with its principal place of practice in the state of Ohio. SEC registration does not constitute an endorsement of OJM by the SEC nor does it indicate that OJM has attained a particular level of skill or ability. OJM and its representatives are in compliance with the current notice filing and registration requirements imposed upon registered investment advisers by those states in which OJM maintains clients. OJM may only transact practice in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. For information pertaining to the registration status of OJM, please contact OJM or refer to the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov.

For additional information about OJM, including fees and services, send for our disclosure brochure as set forth on Form ADV using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

This article contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized legal or tax advice or as a recommendation of any particular security or strategy. There is no guarantee that the views and opinions expressed in this article will be appropriate for your particular circumstances. Because tax law changes frequently, information presented herein is subject to change without notice. You should seek professional tax and legal advice before implementing any strategy discussed herein.

Wealth Planning for the Modern Physician and Wealth Management Made Simple are available free in print or by e-book. Download by texting DERM to 844-418-1212

Newsletter

Like what you’re reading? Subscribe to Dermatology Times for weekly updates on therapies, innovations, and real-world practice tips.