- Acne

- Actinic Keratosis

- Aesthetics

- Alopecia

- Atopic Dermatitis

- Buy-and-Bill

- COVID-19

- Case-Based Roundtable

- Chronic Hand Eczema

- Drug Watch

- Eczema

- General Dermatology

- Hidradenitis Suppurativa

- Melasma

- NP and PA

- Pediatric Dermatology

- Pigmentary Disorders

- Practice Management

- Precision Medicine and Biologics

- Prurigo Nodularis

- Psoriasis

- Psoriatic Arthritis

- Rare Disease

- Rosacea

- Skin Cancer

- Vitiligo

- Wound Care

Publication

Article

Dermatology Times

Looking for Tax Advantages? Consider These 2 Asset Classes

Author(s):

Although our tax code changes somewhat regularly, both real estate and cash value life insurance have shown superior tax treatment for decades.

In our experience, dermatologists, like all physicians, are almost always looking for tax advantages. This typically comes in the form of tax deductions to offset their clinical and practice income. Although this may be most valuable, another important tax-saving element is to find assets that may grow tax free over time. Even more attractive may be the ability to access the increased value of the asset tax free.

Proxima Studio/Adobe Stock

Fortunately, the 2 tax-favored asset classes we will discuss in this article collectively offer all these tax benefits and more. They are real estate and cash value (also called “permanent”) life insurance.

How Are These 2 Assest Classes Similar Tax-Wise?

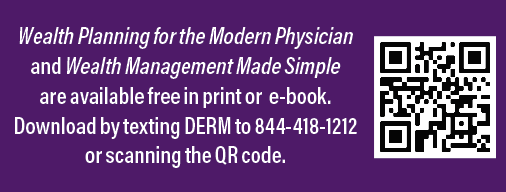

In our book Wealth Planning for the Modern Physician1, we discuss the similarity of real estate and permanent life insurance from a tax perspective. Although our tax code changes somewhat regularly, both of these asset classes have enjoyed superior tax treatment for decades.

An owner of real estate can deduct interest payments on home mortgages within limits and write off depreciation on business real estate. Other tax benefits include a deduction for local property taxes against federal income taxes (this was limited by the last tax code change and may revert to more generous rules under a Biden administration tax act), and a capital gains exemption of up to $500,000 on the sale of the primary home (for a married couple filing jointly).

With permanent life insurance, one can enjoy tax-deferred growth of gains within the policy and, with proper management, access the accumulated value tax free in retirement. In addition, policy death benefits generally are paid to beneficiaries free of income tax, and for those focused on estate planning, one can even structure the death benefits to be paid estate tax free within certain types of trusts.

Further, both asset classes offer a powerful tax benefit that few others provide: The ability to move from one piece of real estate or life policy to another using a tax-free like-kind exchange. These exchanges are controlled by tax code sections 1031 and 1035, respectively.

How Are They Similar as Investments?

Interestingly, from an investment and asset class perspective, these 2 assets are relatively long term. Although there are certainly professional real estate developers or fix-up flippers who do well in the short term, most real estate buyers should think longer term when buying a home, rental, or other real property. Because of the real estate business cycle and the previously mentioned tax benefits, thinking longer term is often savvier. The same is true for permanent life insurance, where the longer term allows time for the tax benefits to outweigh the up-front costs.

Most Physicians Use Only 1 Tax-Favored Asset Well

Most dermatologists already use real estate as a significant part of their balance sheet. This is not surprising, as many doctors own a house, and it is often one of their most valuable assets. Some also own second homes, rental properties, and even raw land. Further, many medical practices purchase real estate rather than renting office space for their practices. In this sense, most dermatologists may not need to reconsider real estate as much as cash value insurance.

In fact, it is typical for physicians to have anywhere from 20% to 50% of their net worth tied up in real estate. Over the years, many have taken full advantage of real estate’s tax benefits, from interest deductions and property tax write-offs to depreciation benefits and like-kind exchanges.

Despite their interest in building tax-favored wealth for retirement, relatively few dermatologists have taken advantage of the significant tax benefits offered by cash value life insurance. This is unfortunate, as the tax-free growth and access of this asset class fits well within a long-term tax diversification strategy for most individuals with a high net worth. Moreover, this asset class has only improved a bit in recent years due to a law that was passed at the end of 2020 as part of the Consolidated Appropriations Act, 2021.

A section of this new law impacted section 7702 of the tax code, which governs life insurance. Essentially, the law allowed insurance companies to reprice their policies using more favorable internal interest rates so consumers could contribute more to permanent policies and enjoy more tax-free growth and access. In other words, this law made an already tax-favored asset class even more favorable and possibly more attractive to dermatologists.

Case Study: The Powerof the Cash Value LifeInsurance Tax Advantage

Let’s look at an example of how a cash value life policy can work as a tax-favored accumulation vehicle. Dan is a 45-year-old dermatologist in good health who wants to invest in either a taxable investment account or a cash value life insurance policy for his retirement. Keeping rates of return equal at 6% annually, Dan wants to see what relative advantages the life policy will produce due to its favorable tax treatment.

Let’s assume Dan invests $25,000 per year for 10 years before retirement, then withdraws funds from ages 65 to 84. Let’s also assume Dan’s tax rate on investments is 29.4% (80% coming from long-term gains and dividends, 20% from short-term gains, plus 6% state tax). With these assumptions, if Dan invests in mutual funds on a taxable basis, he will be able to withdraw $27,103 per year after taxes. If he invests in cash value life insurance, he will withdraw $46,416 per year (no taxes on policy withdrawals of basis and loans) and will still have over $200,000 of life insurance death benefit protection at age 90. This is a substantial difference (assuming the same 6% rate of return) based primarily on the tax treatment of the cash value policy.

Conclusion

Real estate and cash value life insurance are 2 everyday asset classes that can be leveraged to optimize one’s tax planning. As such, it makes sense for dermatologists to reevaluate these asset classes to see how they may fit into their wealth planning.

David B. Mandell, JD, MBA, is an attorney and author of more than a dozen books for doctors, including Wealth Planning for the Modern Physician. He is a partner in the wealth management firm OJM Group (www.ojmgroup.com).

Carole C. Foos, CPA, is a partner and tax consultant. They can be reached at 877-656-4362 or mandell@ojmgroup.com.

Disclosure

OJM Group, LLC (“OJM”) is a US Securities and Exchange Commission (SEC)–registered investment adviser with its principal place of practice in the state of Ohio. SEC registration does not constitute an endorsement of OJM by the SEC nor does it indicate that OJM has attained a particular level of skill or ability. OJM and its representatives are in compliance with the current notice filing and registration requirements imposed upon registered investment advisers by those states in which OJM maintains clients. OJM may only transact practice in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. For information pertaining to the registration status of OJM, please contact OJM or refer to the Investment Adviser Public Disclosure website www.adviserinfo.sec.gov.

For additional information about OJM, including fees and services, send for our disclosure brochure as set forth on Form ADV using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

This article contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized legal or tax advice or as a recommendation of any particular security or strategy. There is no guarantee that the views and opinions expressed in this article will be appropriate for your particular circumstances. Tax law changes frequently; accordingly, information presented herein is subject to change without notice. You should seek professional tax and legal advice before implementing any strategy discussed herein.

Reference

1. Mandell DB, O’Dell JM, Foos CC, Bhatia S. Wealth Planning for the Modern Physician: Residency to Retirement. Fort Lauderdale, Florida: Guardian Publishing; 2020.

Newsletter

Like what you’re reading? Subscribe to Dermatology Times for weekly updates on therapies, innovations, and real-world practice tips.