- Acne

- Actinic Keratosis

- Aesthetics

- Alopecia

- Atopic Dermatitis

- Buy-and-Bill

- COVID-19

- Case-Based Roundtable

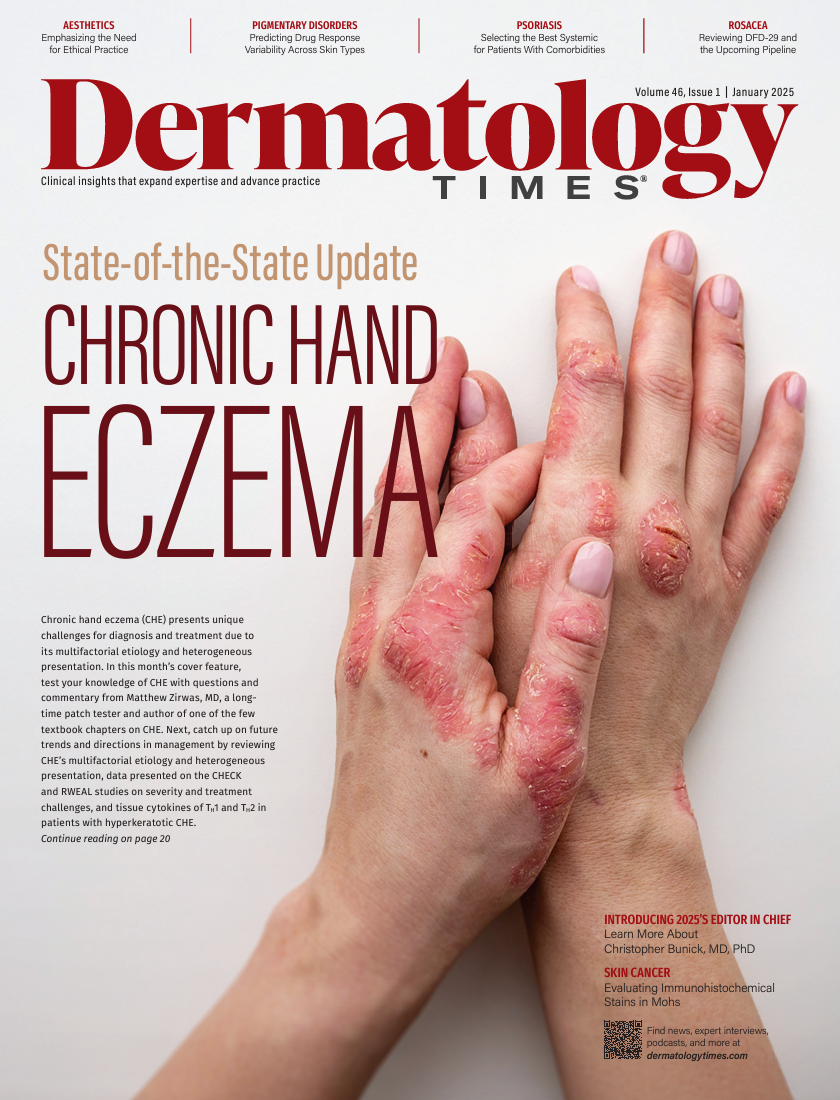

- Chronic Hand Eczema

- Drug Watch

- Eczema

- General Dermatology

- Hidradenitis Suppurativa

- Melasma

- NP and PA

- Pediatric Dermatology

- Pigmentary Disorders

- Practice Management

- Precision Medicine and Biologics

- Prurigo Nodularis

- Psoriasis

- Psoriatic Arthritis

- Rare Disease

- Rosacea

- Skin Cancer

- Vitiligo

- Wound Care

News

Article

Dermatology Times

Success Factors for Employed Dermatologists

Author(s):

Key Takeaways

- Dermatologists should leverage employer-sponsored retirement plans like 401(k), 403(b), and 457(b) for tax benefits and retirement savings.

- Traditional and Roth IRAs offer additional retirement planning opportunities, with backdoor Roth IRAs being a viable option for high earners.

Discover financial strategies and side hustle tips for employed dermatologists to maximize benefits, build retirement wealth, and achieve career success.

Today, more than ever before, more physicians are choosing to be employed by a hospital, government or educational institution, or large practice group. This trend has become evident in the specialty of dermatology, where private practice ownership was the far greater norm for decades. This article focuses on financial strategies for employed dermatologists, including the importance of leveraging an employer’s benefit plans and ideas for those considering side hustles outside of one’s employed work.

Image Credit: © Kittiphan - stock.adobe.com

Leveraging an Employer’s Tax-Advantaged Benefit Plans

Dermatologists who are W-2 employees often can participate in their employer’s retirement plan, which allows them to defer income by contributing to the plan. This participation is crucial because it may be the only tax benefit one enjoys while being employed.

For example, a 401(k) plan is one type of qualified retirement plan (QRP), and it is the most common one offered to physician employees of for-profit entities. Governmental entities and nonprofit health care organizations offer 403(b) plans, which work the same way as 401(k)s.

Government-sponsored 457(b) plans are offered by state and local government health care organizations. Physicians can defer funds into these plans on a pretax basis in addition to contributing to a 403(b) plan.

Nongovernmental organization (NGO) 457(b) plans present a special risk for unwary physicians saving for retirement. While these plans, like 401(k) plans, allow for pretax contributions and tax-deferred growth, they gain these tax benefits only due to a substantial risk of forfeiture imposed by the Internal Revenue Service. Dermatologists who hold these plans can lose everything in them if the sponsoring employer goes bankrupt. While account balances from one nongovernmental 457(b) can usually be rolled over to another nongovernmental 457(b) plan, they cannot be rolled over to an individual retirement account (IRA) or any other type of plan.

A 401(a) plan is a QRP normally offered by government agencies, educational institutions, and nonprofit organizations rather than by corporations. These plans are usually custom-designed and can be offered to key employees as an incentive to stay with the organization. The employee contribution amounts can be pretax or posttax and are normally set by the employer, who must also contribute to the plan.

Use After-Tax IRAs When You Can

Beyond the employer’s QRP, a traditional IRA may also be a helpful tool for an employed dermatologist. The 2025 contribution limits for traditional IRAs allow an individual to defer up to $7000 per year ($8000 per year if they are 50 years or older). Physicians who are not covered by a workplace retirement plan may deduct pretax contributions; all others can make nondeductible or partially deductible contributions (depending on their earned income and filing status). Account balances can grow tax-deferred.

Roth IRA contribution limits are the same as traditional IRA limits; however, most physicians earn more than the adjusted gross income limits for Roth IRAs, so they are not allowed to contribute directly to a Roth IRA. Doctors can often use a backdoor Roth IRA by contributing to a traditional IRA and then converting the traditional IRA to a Roth IRA. (Note: This tactic requires careful planning to avoid unnecessary taxation. Work with an experienced adviser.)

Roth IRAs can be very beneficial in long-term retirement planning because funds in a Roth IRA grow tax-deferred and are tax-free when they are withdrawn from the account. As we discuss in our books, tax diversification is fundamental to long-term tax planning, and a Roth IRA can be part of the tax-free bucket—assets that are distributed tax-free in retirement.

A spousal IRA is a traditional IRA or Roth IRA that receives contributions on behalf of a nonearning spouse. To contribute, the nonearning spouse must meet the ordinary requirements for making an IRA contribution except that they are not required to have earned income. Instead, the earning physician must make enough income to cover the spouse’s contribution. The normal IRA contribution limits apply to the spousal IRA.

Side Hustles Outside of Employment

At some point in their careers, many employed dermatologists may consider an outside activity or side hustle to make additional income. These might include the following:

- Locum tenens (temporary, contract) work

- Moonlighting

- Expert medical witness

- Telemedicine

- Consulting to industry

- Paid speaking

- Medical surveys

- Creating a patentable medical device

- Real estate investing

- Launching a start-up

If you may take this path, consider a few of the following success factors:

1. Brand yourself

Whether you are launching an entrepreneurial venture and want to attract investors or you never engage in a side hustle and simply want to build a successful clinical practice, your reputation among colleagues, staff, patients, and the general public is paramount. Professional referrals and online reviews are indicative of what others think of you and your work for patients.

2. Understand your employment contract

If you want to pursue an entrepreneurial activity or side hustle, your first step must be to understand the current rules and restrictions under which you are presently working. This means a review of your current employment agreement and a possible discussion/renegotiation to allow you to proceed.

3. Structure the side hustle for maximal tax and protective benefit

One of the significant upsides to earning additional income through entrepreneurship and side hustles is that you can structure that income to maximize its protection from liability and minimize its taxation, so that the side hustle can meet each doctor’s financial goals and situation. This is especially valuable for dermatologists employed by large institutions or in groups where they have virtually no say on the tax treatment of their income.

If the doctor can justify the cost, a separate limited liability company can be created for the side hustle. For others, no entity is needed, but insurance is essential. For example, covering locum tenes and moonlighting work with a medical malpractice policy is important, whereas landlord-type policies may make sense for real estate ownership.

Tax considerations should always be made to minimize state and federal tax costs on outside income.

Conclusion

As an ever-increasing number of dermatologists are likely to be employed rather than own private practices, it is crucial that these doctors maximize participation in their employers’ benefit plans and consider traditional and Roth IRAs to build retirement wealth. Additional planning opportunities may open up for dermatologists who decide to implement a side hustle during the course of their employment.

David Mandell, JD, MBA, is an attorney and author of more than a dozen books for doctors. He is a partner in the wealth management firm OJM Group (www.ojmgroup.com) and can be reached at 877-656-4362 or mandell@ojmgroup.com.

Disclosure:

OJM Group, LLC. (“OJM”) is an SEC registered investment adviser with its principal place of business in the State of Ohio. SEC registration does not constitute an endorsement of OJM by the SEC nor does it indicate that OJM has attained a particular level of skill or ability. OJM and its representatives are in compliance with the current notice filing and registration requirements imposed upon registered investment advisers by those states in which OJM maintains clients. OJM may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. For information pertaining to the registration status of OJM, please contact OJM or refer to the Investment Adviser Public Disclosure web site www.adviserinfo.sec.gov.

For additional information about OJM, including fees and services, send for our disclosure brochure as set forth on Form ADV using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

This article contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized legal or tax advice, or as a recommendation of any particular security or strategy. There is no guarantee that the views and opinions expressed in this article will be appropriate for your particular circumstances. Tax law changes frequently, accordingly information presented herein is subject to change without notice. You should seek professional tax and legal advice before implementing any strategy discussed herein.

Newsletter

Like what you’re reading? Subscribe to Dermatology Times for weekly updates on therapies, innovations, and real-world practice tips.