- Acne

- Actinic Keratosis

- Aesthetics

- Alopecia

- Atopic Dermatitis

- Buy-and-Bill

- COVID-19

- Case-Based Roundtable

- Chronic Hand Eczema

- Chronic Spontaneous Urticaria

- Drug Watch

- Eczema

- General Dermatology

- Hidradenitis Suppurativa

- Melasma

- NP and PA

- Pediatric Dermatology

- Pigmentary Disorders

- Practice Management

- Precision Medicine and Biologics

- Prurigo Nodularis

- Psoriasis

- Psoriatic Arthritis

- Rare Disease

- Rosacea

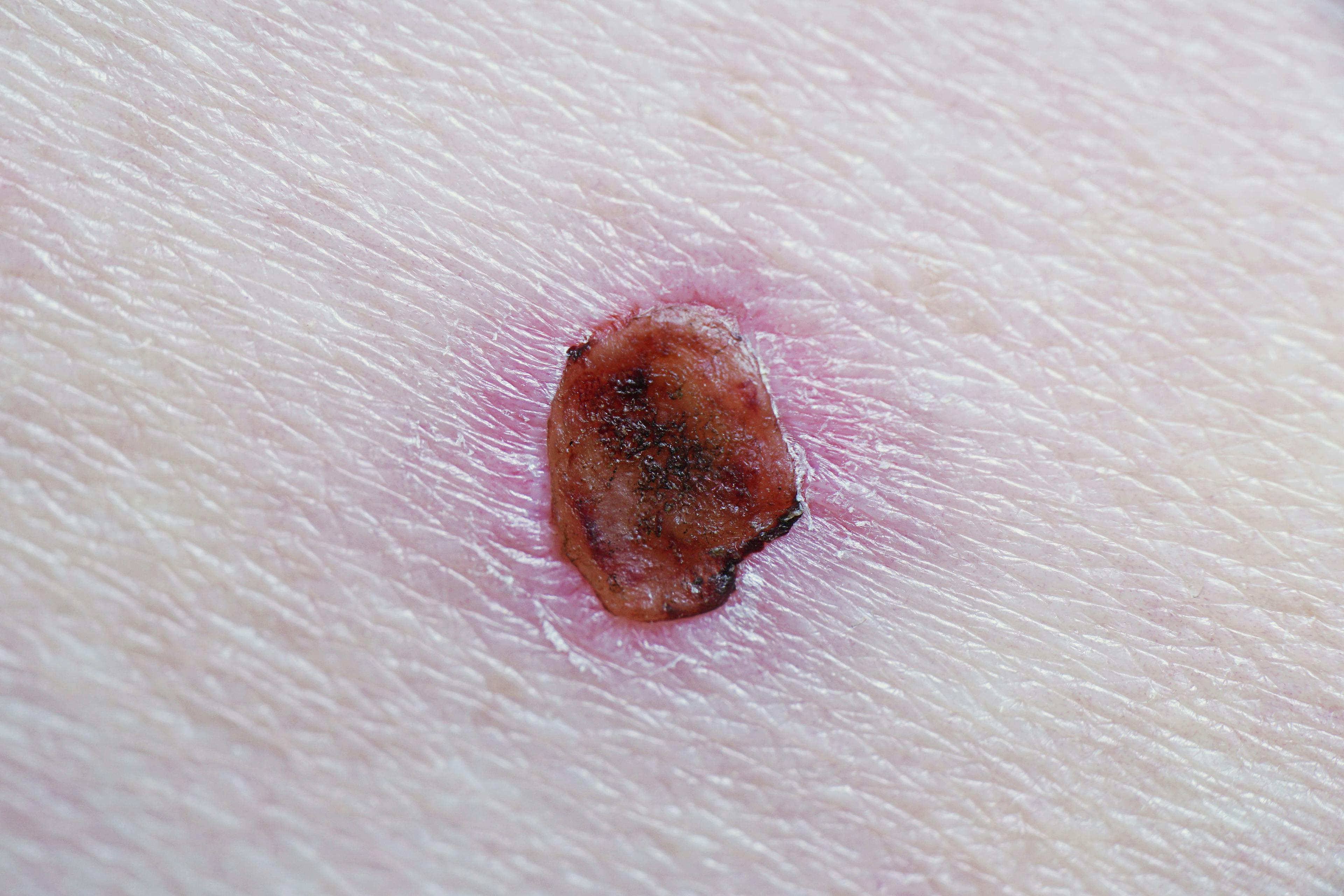

- Skin Cancer

- Vitiligo

- Wound Care

Publication

Article

Dermatology Times

Estate Planning Essentials: What Dermatologists Should Know

Author(s):

In this month's finance and practice management article, David Mandell, JD, MBA, and Carole Foos, CPA, discuss estate planning for dermatologists.

The term estate planning is commonly known to dermatologists, along with most individuals, as the type of planning one does in contemplation of death—creating wills, trusts, and other documents to handle issues after one is gone. Although that is part of the discipline, it is not all. Rather, proper estate planning should encompass several tactics that can have significant impact during one’s life, from annual gifts to planning for the possibility of being legally incapacitated.

In fact, estate planning can be thought of as the following 3 distinct planning areas:

- Incapacitation planning deals with decision-making regarding legal, financial, and medical issues if one is unable to make decisions for oneself.

- Estate distribution planning concerns what happens to assets upon death.

- Transfer tax planning addresses and plans for the various gift, estate, and other taxes that may be triggered under state and federal laws when transferring wealth during life or at death.

In this article, we will provide an overview of incapacitation planning and estate distribution planning, including the recommended documents for each.

Incapacitation Planning

Planning for one’s own incapacitation (ie, what happens if you are not able to make decisions for yourself) is never pleasant but always important.

As an example, what happens if you are hospitalized and cannot express your wishes regarding decisions that need to be made about your medical care? Many physicians assume that their family members would automatically be able to make decisions in this scenario. However, rules vary greatly from state to state. In some cases, decisions are left up to the health care providers and institutions in charge of your care. Also consider what may happen if such decisions can be made by your family members, but they do not all agree on the best course of action.

You should have several key documents in place. The exact names and requirements are controlled by state law and will vary. These documents include the following:

- Living will. This is a written record of the type of medical care you would want in specific circumstances.

- Health care proxy. This document names someone you trust as your proxy, or agent, to express your wishes and make health care decisions for you if you are unable to speak for yourself.

- Advance directive. This term often refers to a combination of the living will and health care proxy documents.

- Power of attorney. This document names someone you trust as your agent to make property, financial, and other legal decisions on your behalf.

Estate Distribution Planning

If you die without a will, then your property will pass under the scheme that your state legislature has written for its citizens. This is what is known as dying “intestate.”

There are various negative consequences of dying intestate. Although the precise rules vary among the 50 states, the laws are typically very rigid and formulaic. Usually, your nearest relatives get a piece of your property, but no one else does—not friends, cousins, charities, or anyone else. Furthermore, no one gets more than the state-allotted share, even if that seems unfair. Often, this ends up hurting the surviving spouse if there is one. In this all-too-common scenario, the decedent’s grown children may get some of the money meant for the surviving spouse, even if it means the surviving spouse then has too little to live on. In larger estates, this could have the very impractical effect of creating an estate tax payable when the first spouse dies if the children’s intestate share of the estate exceeds the federal or state exemption amount. Moreover, intestacy may lead to expensive and lengthy court battles by family members contesting the division of assets.

Perhaps the most upsetting thing about intestacy is what occurs if one has minor children: If both parents die intestate, the courts will decide who becomes the legal guardian of the children. Furthermore, any minor children will receive their share of the estate when they turn age 18 years, rather than at some more appropriate later age that one can specify with proper planning.

Living Trusts and Pour-Over Wills

Although estate planning documentation is completely state dependent, we can say that in every state, having a will is better than not having a will. However, in many states, with a will alone, your entire estate will be stuck in the probate process. Probate is the court-controlled public process by which the state administers your will.

In most states, knowledgeable estate planning advisors recommend combining a living trust with a short will called a “pour-over will” because this combination ensures that much of an estate will avoid probate. Depending on the state, probate can be time-consuming, public, and very costly. In many states, the goal is to avoid the process as much as possible.

The Living Trust: A Foundational Estate Planning Document

Living trust (or “family trust”) is a common name given to a revocable trust (which, unsurprisingly, is revocable, meaning you can revoke it or amend it anytime during your life).

Regardless of its marketing name, the living trust is a revocable trust that provides direction for the use of your assets both while you are alive and at the time of your death. During your life, the assets transferred to the trust are managed and controlled by you, as the trustee, just as if you owned them in your own name. When you die, these trust assets pass to whomever you designated in the trust, automatically, outside the probate process. Other benefits of the living trust include the following:

- prevention of court control of assets if you become incapacitated;

- protection of beneficiaries with special needs; and

- the ability to nominate guardians to take care of your children if you are incapacitated (but still alive) or when you die.

Estate Planning Is a Must for Dermatologists of All Ages

Incapacitation planning is essential for physicians of any age, and estate distribution planning is valuable for those with even minimal assets. Every dermatologist should engage in basic estate planning sooner rather than later.

Disclosure:

Mandell is an attorney and founder of the wealth management firm OJM Group in Cincinnati, Ohio. Foos is a partner and tax consultant at OJM Group.

OJM Group, LLC (“OJM”) is a Securities and Exchange Commission (SEC)–registered investment adviser with its principal place of practice in the state of Ohio. SEC registration does not constitute an endorsement of OJM by the SEC nor does it indicate that OJM has attained a particular level of skill or ability. OJM and its representatives are in compliance with the current notice filing and registration requirements imposed upon registered investment advisers by those states in which OJM maintains clients. OJM may only transact practice in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. For information pertaining to the registration status of OJM, please contact OJM or refer to the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov.

For additional information about OJM, including fees and services, send for our disclosure brochure as set forth on Form ADV using the contact information herein. Please read the disclosure statement carefully before you invest or send money.

This article contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized legal or tax advice or as a recommendation of any particular security or strategy. There is no guarantee that the views and opinions expressed in this article will be appropriate for your particular circumstances. Because tax law changes frequently, information presented herein is subject to change without notice. You should seek professional tax and legal advice before implementing any strategy discussed herein.

Wealth Planning for the Modern Physician and Wealth Management Made Simple are available free in print or by e-book. Download by texting DERM to 844-418-1212

Newsletter

Like what you’re reading? Subscribe to Dermatology Times for weekly updates on therapies, innovations, and real-world practice tips.